Dive into the World of Business Funding!

Are you ready to take your business to the next level? One of the key factors in growing a successful business is having access to the right funding. Whether you’re just starting out or looking to expand, understanding your options when it comes to business funding is crucial.

There are a variety of funding choices available to entrepreneurs, each with its own benefits and drawbacks. From traditional bank loans to crowdfunding platforms, the world of business funding is vast and diverse. By exploring your options and finding the right fit for your business, you can set yourself up for success and take your venture to new heights.

One of the most common forms of business funding is a traditional bank loan. Banks offer loans to businesses based on their creditworthiness and business plan. While bank loans can provide a significant amount of capital, they often come with strict requirements and high interest rates. However, for established businesses with a strong credit history, a bank loan can be a reliable source of funding.

Another popular option for business funding is angel investors. Angel investors are individuals who provide capital to startups in exchange for equity in the company. These investors can offer not only financial support but also valuable expertise and connections. However, working with angel investors means giving up a portion of ownership in your business, so it’s important to carefully consider whether this is the right choice for you.

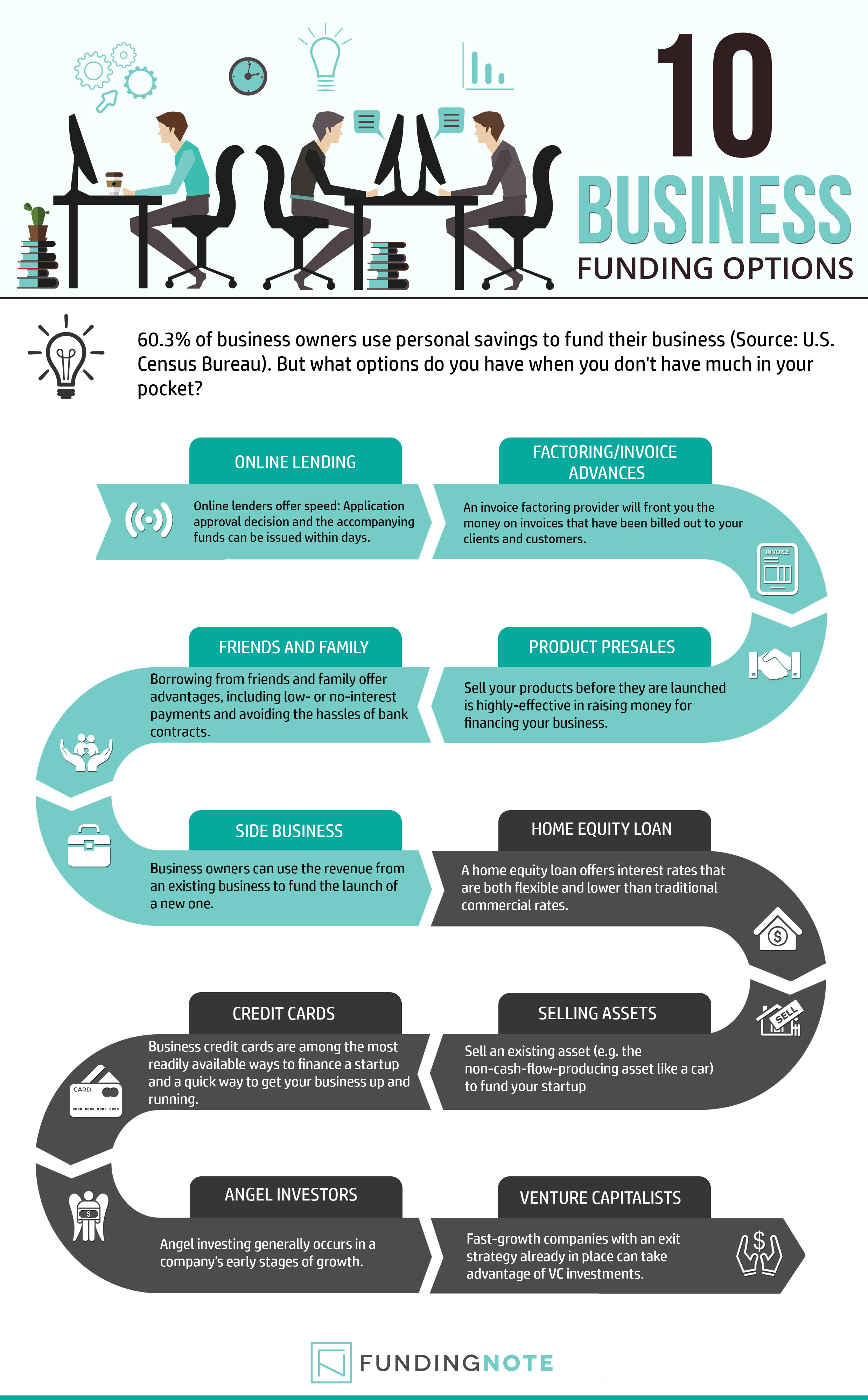

Image Source: fundingnote.com

Venture capital is another common funding choice for startups and high-growth businesses. Venture capital firms invest in early-stage companies with high growth potential in exchange for equity. While venture capital can provide a significant amount of funding, it also comes with high expectations for growth and a loss of control over the business. For entrepreneurs looking to scale quickly, venture capital can be a powerful tool.

If you’re looking for a more flexible and accessible funding option, crowdfunding may be the right choice for you. Crowdfunding platforms like Kickstarter and Indiegogo allow businesses to raise capital from a large number of individuals. Crowdfunding can be a great way to validate your business idea, build a community of supporters, and raise funds without giving up equity. However, running a successful crowdfunding campaign requires a strong marketing strategy and a compelling story.

For businesses in need of short-term funding, a business line of credit can be a valuable resource. A business line of credit is a revolving credit account that allows businesses to borrow funds up to a certain limit. This type of funding can help businesses manage cash flow, cover unexpected expenses, and take advantage of growth opportunities. With a business line of credit, you only pay interest on the funds you use, making it a flexible and cost-effective funding choice.

No matter what stage your business is at, there are funding choices available to help you achieve your goals. By exploring the world of business funding and finding the right fit for your business, you can unlock the potential for growth and success. So dive in, explore your options, and take your business to new heights with the right funding choice!

Unleash Your Potential with the Best Choices!

Are you ready to take your business to the next level but unsure of how to secure the funding you need? Look no further! In this ultimate guide to business funding choices, we will explore the various options available to help you unleash your full potential and make your entrepreneurial dreams a reality.

One of the best choices for business funding is traditional bank loans. Banks offer a reliable and established way to secure the capital you need to grow your business. With competitive interest rates and flexible repayment terms, bank loans provide a solid foundation for financing your expansion plans.

Another popular option for business funding is venture capital. Venture capitalists are investors who provide funding in exchange for equity in your company. This can be a great choice for businesses with high growth potential, as venture capitalists often bring valuable expertise and connections to the table.

If you prefer to maintain full control of your business, crowdfunding may be the right choice for you. Crowdfunding platforms allow you to raise funds from a large number of people, often in exchange for rewards or pre-orders of your products. This can be a fun and engaging way to connect with your customers and raise the capital you need to take your business to the next level.

For businesses in need of a quick cash infusion, merchant cash advances are a flexible and convenient option. With a merchant cash advance, you can receive a lump sum of cash upfront in exchange for a percentage of your future credit card sales. This can be a great way to access the funds you need quickly, without the hassle of a lengthy application process.

If you have a solid track record of sales, invoice financing may be the best choice for your business. With invoice financing, you can sell your unpaid invoices to a lender in exchange for immediate cash. This can help improve your cash flow and provide the funding you need to keep your business running smoothly.

Lastly, don’t overlook the power of personal savings and investments. By investing your own money into your business, you demonstrate your commitment and dedication to its success. This can also make your business more attractive to other investors and lenders, as it shows that you have skin in the game.

In conclusion, when it comes to business funding choices, the possibilities are endless. Whether you choose traditional bank loans, venture capital, crowdfunding, merchant cash advances, invoice financing, or personal savings, there is a funding option out there to help you unleash your full potential and achieve your business goals. So don’t wait any longer – dive into the world of business funding and take your business to new heights!

The Ultimate Guide to Business Funding Options